|

|

|

|

#1 |

|

Administrator

|

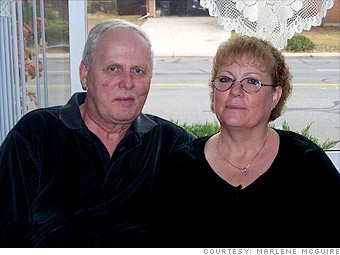

Life after foreclosure

After losing their homes, these 4 families thought they'd never recover. They've found it difficult to rent and their credit is wrecked, but life is looking up.  Stephanie and husband, Rich, with their eldest son, Mason, and the twins, Emily and Evan. City: Chicago Price paid: $245,000 Current value: 175,000 Lesson: "My only regret is that ... we signed a contract and then we couldn't fulfill that contract." Stephanie Thomson's troubles began when her husband Rich, a highly regarded hair designer, became disabled with neuropathy and could no longer work. The income loss made it impossible for the couple to sustain the payments on their home in a Chicago suburb. When they bought the house, they took out a hybrid ARM mortgage. The original bill was $1,400 a month. But it went to $1,900 after three years and more than $2,000 after the second reset six months later. "With my husband unable to work, we could have paid the mortgage without the ARM reset but nothing more," says Stephanie, who tried for months to get help from her lender. "They told me they would pray for me. That's an exact quote," she says. The Thomsons decided to stop paying their mortgage last July -- their first time missing a payment. They didn't pay for 10 months, during which time YouWalkAway.com helped guide them through the foreclosure process. In April, having saved what they would have paid in mortgage, they relocated to Elyria, Ohio, where Stephanie has relatives. Unfortunately, their credit scores had dropped so low that it was difficult to rent -- much less buy -- a new place. So Stephanie's mom bought a house and rents it to them. "It's less expensive here; we were able to get a larger house in a wonderful neighborhood," she says. "My only regret is that I'm a proud person. We signed a contract and then we couldn't fulfill that contract because of my husband's illness. It was very difficult."  Lori and Bill DiBacco City: Oceanside, Calif. Price paid: $610,000 Current value: $550,000 Lesson: "It was so horrible, the worst stress we'd ever been under." Apparel sales rep Lori DiBacco and her musician husband, Bill, were living a dream life in their five-bed, three-bath home with pool in beautiful Oceanside, Calif. They bought the place in 1994, and they lived well, but not wisely. "We took great vacations, if we saw something we wanted we bought it," says Lori. The couple was childless by choice, as they both traveled for work. Then, five years ago, their goddaughter came to live with them. That radically altered everything. Bill stopped working so someone would be home, which halved the couple's income. Then, there were big expenses for taking care of the child. "She needed a lot of extra care," Lori says. "We put a lot of money into her education, dropping $50,000 the first year into Sylvan Learning Center for remedial work." The coup-de-grace happened when Lori injured her back and couldn't work. They burned through their savings and took out a second loan on the house. Their monthly mortgage bill, about $1,400 when they first bought the house, ballooned to $4,400. They started missing payments; they simply didn't have the money. They went nine months without paying. "Oh my God, it was so horrible, the worst stress we'd ever been under," Lori says. "It sent my husband over the edge to a nervous breakdown." By the time they were done, they owed $610,000 on a property that was worth just $550,000 when they did a short sale last year. Things are much better now. Bill runs a business restoring classic Mustangs, and Lori started a pet concierge business, which arranges everything for the pampered pet. She calls working with animals her dream job. Their finances are still tattered. They were turned down for several places they tried to rent. They're living in a condo owned by Bill's mom, paying a small rent but fixing the place up. Lori loves the new place; it's in a quiet 55-plus community with very nice neighbors, most of whom have pets. "We almost divorced many times over the stress of the financial burden and all that entailed," Lori says.  Ron Nash City: Carlsbad, Calif. Price paid: $840,000 Current value: $600,000 Lesson: "Nothing was lost but a big, freaking headache." This California resident bought his house nine years ago in a gated community within the posh, seaside city of Carlsbad. He took out an adjustable rate mortgage to keep the initial monthly payments affordable, but by this spring his monthly mortgage bill was $5,600. At the same time, he found himself severely underwater thanks to falling home prices and several cash-out refinances. The headhunter and motivational speaker couldn't afford that big a payment and realized he wasn't likely to make back nearly a quarter-million dollars in value. He tried for months to work something out with his lender, but he says, "They made me an offer that was unacceptable." Instead, Nash, who is married with two kids, decided to go through the foreclosure process. He didn't pay the mortgage for 18 months and finally vacated in June. Not having a housing payment during that time kept him from financial ruin since his headhunting business was in a tailspin. Nash and his family are now living in a $1,900-a-month rented townhouse in the same great neighborhood just a half mile away from their former home. "I downsized about 1,000 square feet to a 1,500-square-foot home," he says. "Hey! It's a lot easier to clean." He feels like he landed on his feet in just about every way: His kids were able to stay in the same school; he stayed in the same location, which is like living in a beach resort; and he's spending a lot less on housing. "Nothing was lost but a big, freaking headache," he says. Still, he counts himself lucky that he was able to find the new place. Most large-scale commercial property complexes wouldn't rent to him because his credit was so tattered, but he found a woman who had just lost her job and needed to leave her townhouse on short notice. He had just received a big check for a head-hunting transaction he had just closed so he got the place. His advice for others: "Make sure you take care of your family. And don't get attached to mere things."  Marlene and Bill McGuire City: Northglenn, Colo. Price paid: $261,000 Current value: $180,000 Lesson: "You have to get out of the house when no one will help you." The McGuires purchased their home in 2005 and made the $1,500 a month payments faithfully. When their adjustable-rate loan began to reset, the increases were small, just $50 to $75 or so. But they added up, and soon the couple was paying more than $2,100 a month. That was a tough nut for Marlene's husband, Bill, to manage even though he earns good money as a long-distance trucker. The tri-level had three bedrooms upstairs and another suite in the basement. "It had all the extras," says Marlene, a homemaker in Northglenn, Colo. Getting advice from YouWalkAway.com, a Web site that guides people through the foreclosure process, the McGuires realized that they owed much more than the property was worth and the upkeep costs were beyond what they could pay. Even though Marlene loved her house, they opted for a short sale and found a buyer at $180,000. The lender approved the deal, and they moved out, free and clear. They continued making their regular payments each month until they left their house. Because they were not delinquent, their credit didn't suffer too much at first, but the short sale did hit hard.They now live in a mobile home. "That's the best we can do right now," said Marlene. "But, the stress is over. My husband and I were not getting along; there was conflict. It was making me very sick. You have to get out of the house when no one will help you." http://money.cnn.com/galleries/2009/...ure/index.html |

|

| Tags |

| foreclosure |

| Share |

«

Previous Thread

|

Next Thread

»

| Thread | |

| Display Modes | |

|

|

All times are GMT -5. The time now is 09:21 AM.

Page generated in 0.13675 seconds.

Linear Mode

Linear Mode